The Asia-Pacific region has witnessed a burgeoning startup ecosystem in recent years. A survey conducted by angel investor Arnaud Bonzom shed more light on the APAC startup landscape, giving more detail on investments received in the region.

APAC startups have captured a combined US$9.4 billion in venture capital funding across a total of 436 investments, according to Arnaud’s report, which is based on data from Asia Funding/M&A Newsletter. Thirty VC funds in the region closed a total US$4.44 billion investments with the largest single deal standing at US$910 million.

The report summed up five key trends in the venture capital landscape so far this year:

- e-commerce and marketplaces captured 53 per cent of the investments by value

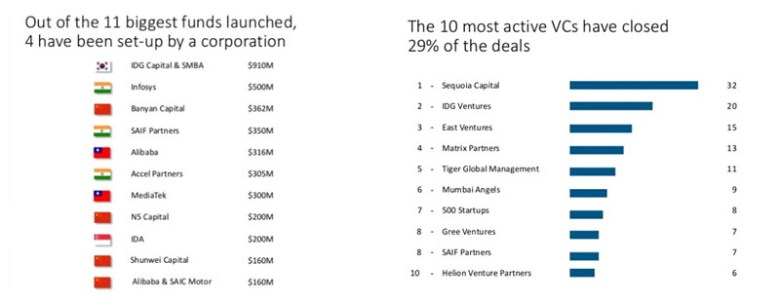

- Out of the eleven biggest funds launched, four were set up by a corporation

- Nine out of the ten biggest deals were done in China

- 67 per cent more deals have been done in India than in China

- The ten most active VCs have closed 29 per cent of the deals

As the largest economic entity in the region, China accounts for nine out of the ten biggest deals. Dianping, China’s leading local ratings and reviews service, took the top spot with a recent US$850 million funding round, while its major rival Meituan followed with US$700 million in financing. With lots of overlapping businesses in group-buying and O2O expansion, the battle between the two companies is expected to escalate after receiving this new funds. Taxi app Kuaidi Dache ranked third with US$600 million in funding as an independent company, although it has since merged with its fierce rival Didi Dache in February this year.

The 6th to 10th spots were taken by smartphone maker Meizu (US$590m), film and television programme producer Enlight Media (US$383m), online food ordering service Ele.me (US$350m), decoration service To8to (US$200m), used car trading platform Youxinpai (US$200m) and video streaming site Imgo.tv (US$200m).

Indian payment finance service One97 Communications, which ranked the fifth in the list, received US$575m worth of investment from Chinese e-commerce giant Alibaba. Thus, all of the top 10 deals are linked to China in some way.

In terms of funding stages, Series D or beyond deals stood at US$4.03 billion, accounting for the largest share (43%) of total investments, while seed-stage round deals represented just US$60 million or just 3% of the total investments.

China had a good spread of investments across the stages of the funding cycle, from early to late, while most of the deals occurred in Series A financing.

India recorded 67% more deals than China in volume, but China’s deals were worth 3.9 ties more in terms of value.

Of the 11 biggest funds launched, four have been set up by corporations, indicating a trend for big enterprises to keep up with the ever-developing innovation and to play a bigger role in the game. Amongst the funds, Sequoia Capital is the most active one in the region with 32 deals.

Image credit: Startintx, Shutterstock

Editing by Mike Cormack (@bucketoftongues)